The Scarlet Data

Will Common Core State Standards and SBAC testing finally banish the shaming over test scores that has been going on this last decade an a half? It is my understanding that SBAC score reporting will take the focus off individual students – and thankfully, teachers – and place it more on schools and school districts.

This is good news for those of us who believe the emphasis should be on learning and not on achieving high test scores. Students should not be shamed by a number – no more should they wear their “scarlet data”.

See this blog for more: http://www.spencerideas.org/2013/03/am-i-still-good-teacher-thoughts-on-bad.html

Your Tax Dollars at Work

California’s education system is funded by tax-payers. While this is common knowledge, the quality of those taxes is less known. This blog post seeks to rank types of taxes to discover which are best for funding education, and to examine equity and adequacy issues for school districts and tax payers.

A report by the Legislative Analyst’s Office details five common economic criteria for evaluating tax systems (Taylor, 2012). They are as follows:

- Growth – Does revenue raised by the tax grow along with the economy or the program responsibilities it is expected to fund?

- Stability – Is the revenue raised by the tax relatively stable over time?

- Simplicity – Is the tax simple and inexpensive for taxpayers to pay and for government to collect?

- Neutrality – Does the tax have little or no impact on people’s decisions about how much to buy, sell, and invest?

- Equity – Do taxpayers with similar incomes pay similar amounts and to tax liabilities rise with income?

According to a PowerPoint authored by a Concordia University professor, there are five sources of funding for school districts. Local property tax is listed as one source, and contributes 22% to the funding budget (McClellan, 2014). The State is also listed, and makes up 59%. The same PowerPoint informs that the primary sources of revenue for the state of California include personal income tax, sales tax, and also lists property tax (McClellan, 2014).

Since it is listed twice, property tax will be examined first. As for growth, property taxes have grown faster than the economy (Taylor, 2012). For stability, the value assessment of most properties does not change often, contributing to a stable source of revenue from this tax. Simplicity in taxes can be described as easy to understand and inexpensive to collect (Taylor, 2012). Though this tax does cost a bit of money to collect, it is fairly easy to understand, so its ranking is high in the simplicity category. Neutrality is more difficult to assess, as taxes do tend to alter the behavior of taxpayers, at least a bit (Taylor, 2012). Equity is a category in which property taxes rate very low, as property owners are not all taxed at the same rate.

Next to be examined is income tax. Income tax is more closely aligned with the economy than either property or sales taxes (Brimley, Verstegen, & Garfield, 2012). It is a relatively stable tax. Corporate income tax can be “complex and difficult to administer” (Brimley, et al., 2012), making it lower ranking in simplicity. Its neutrality is unclear, but equity is improved due to progressive tax rates and tax brackets.

Last to be examined here is sales tax. Sales tax makes up almost one-third of state tax revenue and is the largest state tax source (Brimley, et al., 2012). It is sensitive to economic growth, and is therefore as stable as the economy. It’s low cost for collection gives it a high simplicity ranking (Brimley, et al., 2012). However, equity is compromised as it tends to overburden poor families (Brimley, et al., 2012).

Based on these considerations, income tax is the most equitable for tax payers, and has the highest ranking. Sales tax is the least equitable, and scores the lowest. The best tax for education is property taxes. Even though it is not as equitable for tax payers, it is tied to local areas in order to support school capital outlays.

Resources:

Brimley, V., Verstegen, D., & Garfield, R. (2012). Financing education in a climate of change (11th ed.). Boston: Pearson.

McLellan, T. (2014). Overview: Current system for funding public education in California. PowerPoint from EDD 705 Sustained fiscal leadership for organization reform.

Taylor, M. (2012, November). Understanding California’s property taxes. Legislative analyst’s office (LAO).

California School Finance

This blog post will report on legislation concerning California’s past efforts to reform educational finance, and analyze the laws in terms of effectiveness in addressing equity and adequacy. Specifically, this blog post will examine Serrano II and AB65.

Historically, California school financing was tied to property taxes raised within each school district. In the richer districts, more revenue could be raised by levying taxes at low rates. However, poorer districts had to levy taxes at higher rates and could not realistically raise as much revenue (Karst, 1972). Early school finance laws brought about higher spending in the relatively wealthier school districts, and reduced spending in the relatively poorer school districts, with relative wealth being determined by district property tax bases (Picus, 1991). This formula for school finance was found to be unconstitutional (Karst, 1972).

Before Serrano II in 1976, there was Serrano v. Priest in 1971, sometimes called Serrano I. This legislation was an indication that the California’s established school finance system did not meet the demands of the state constitution (Picus, 1991). This ruling separated wealth based on local property tax from school spending (Fischel, 1989). This ruling by California’s Supreme Court is considered a “share the wealth” decision, and prevents variations in school spending based on a school district’s taxable property wealth (Fischel, 1997). In Serrano II, the California Supreme Court pushed the revised school finance formula even further. A new ruling required that state and local spending combined could not vary by more than $100 per pupil across school districts (Fischel, 1989). One negative impact of Serrano II was that it restricted the ability of school districts to adjust education expenditures in response to community needs (Downes, 1992).

Assembly Bill 65 (AB65) was passed in 1977 in response to Serrano II. It sought to equalize school funding by applying a minimum tax rate in all school districts and by transferring funds from wealthier school districts to poorer ones (Picus, 1991). AB65 limited wealthy districts’ spending, taxing richer districts and giving that money to the state to be re-distributed to less affluent ones. An impact of this legislation was that voters rejected the tax, thus shifting the burden of school finance to the state (Fischel, 1989).

References

Downes, T. A. (1992). Evaluating the impact of school finance reform on the provision of public education: The California case. National Tax Journal, 405-419.

Fischel, W. A. (1989) Did Serrano cause Proposition 13? National Tax Journal, 465-473

Fischel, W. A. (1997). Blame judges, not voters, for California’s declining schools. New York Times.

Karst, K. L. (1972). Serrano v. Priest: A state court’s responsibilities and opportunities in the development of federal constitutional law. California Law Review, 720-756.

Picus, L. O. (1991). Cadillacs or Chevrolets?: The evolution of state control over school finance in California. Journal of Education Finance, 33-59.

CTEOnline

CTEOnline is an online resource for free lesson plans and projects that incorporate rigorous academic standards with career technical education.

This week, I’m in Sacramento with three of my colleagues participating in the 2014-2015 CTEOnline Institute – Integrated Curriculum Writing Group. We are learning how to create an interdisciplinary project that addresses Engineering and includes linked lessons in History, English Language Arts, and Japanese.

All lessons and projects are available for free – just register for an account and browse through over 3000 lessons based on CTE standards, Common Core and Next Generation Science Standards. There are projects and course outlines posted, as well as many other instructional resources. Check it out at cteonline.org.

Sharing the Wealth on Donors Choose

Donors Choose partnered with Google and Kahn Academy to promote girls learning computer programming. For every girl I could get to register under my coach name in Kahn Academy and complete a course on how to code in Java, Donors Choose gave me a $100 gift code. I used these codes to purchase laptops for my VEX Robotics students to program their robots and to display their robots’ design and development at robotics tournaments.

I earned 15 of these gift codes, and ended up with one left over. Browsing the projects posted on the Donors Choose website, I found the perfect place to spend my extra $100. Ms. Andrade in Hawthorne, CA posted a project about using roller coasters to teach engineering. She will be using Project Lead the Way curriculum at her middle school; I also use this curriculum at the high school where I teach. So I chose to donate to her project. She still needs more money, so you should donate, too. Way to go Ms. Andrade, and best of luck to you and your students!

Reflecting on Learning About Infographics

For this assignment, I went back to a reference I had used for my research paper. My topic was on using online resources to promote girls’ interest in pursuing careers in STEM. Pew had published data on social media users that I found quite interesting. Infographics provides a visual way to display data. The website Pictochart.com made it easy to create an infographic. I used one of their free templates and added some icons. Then I just input my data and there it was: a beautiful display. Included at the bottom are ways that educators can incorporate social media into their instruction.

https://magic.piktochart.com/output/2140350-who-uses-social-media

Reflecting on Common Core Math Standards

Common Core State Standards are ushering in some exciting changes for education. The are three key shifts in math: greater focus on fewer topics, a coherent curriculum with links among topics and across grade levels, and an increase in rigor through real-world applications and modeling (representing quantitative data in a visual way). Which do you think will have the greatest impact on instruction? Please comment.

All these changes have implications for education moving forward. Math teachers, who have taught the same basic way for many years, will need to learn new ways of instructing. They will need new materials and new technology. Training, materials, and technology cost money, so a major implication of the switch to Common core State Standards is the financial cost. However, this cost is an investment in our future.

Please comment on the implications you predict for the shift in math standards.

Image: http://www.abcteach.com/directory/common-core-standards-math-10666-2-1

Social Issue and Pedagogy – Changing Education

Are we trying to meet the future by doing what we did in the past? There is a lot of educational reform going on in the world today. We need to educate our children to succeed in tomorrow’s economy, and we don’t even know what tomorrow’s economy looks like. But we know that the industrial revolution factory model is outdated. Yet we still have bell schedules and a production line approach to teaching. This video brings up some food for thought. Now I’m looking for the answers. Social media is a good place to start when seeking an answer to how to best change our educational model.

Good To Know – Week of 6/2/14

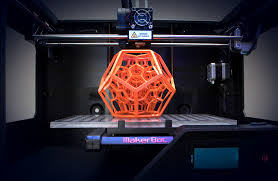

MakerBot Just Got More Accessible

MakerBot Just Got More Accessible

MakerBot and Tech Data just announced a new distribution agreement. Now it will be easier than ever to buy a desktop 3D printer. DonorsChoose is offering an education bundle with a Makerbot, filament, and lesson ideas. Ooooh, I want one!

If you don’t want one, read this and you might. 3D printing is changing the world!

http://www.alternet.org/story/155254/future_tech%3A_how_3d_printing_will_change_the_world

Distribution Agreement

http://www.marketwatch.com/story/makerbot-and-tech-data-announce-distribution-agreement-2014-06-03

Easy-Bake Robots?

A 3D printer made the material for these robot “nets”. When heat is applied, the material folds itself into a robot. I wish it was this easy to make our school’s VEX robots. No, not really. Building and re-building is half the fun!

Check out these fold-a-bots:

http://www.alternet.org/story/155254/future_tech%3A_how_3d_printing_will_change_the_world

Got 3D Printing?

For those of us without a 3D printer, we can still get in on the action. You can create a computer-aided design, then send it to a 3d printing service to bring your creation to 3D life. I saw this on Twitter @shapeways

Theo Jansen

The image on @shapeways reminds me of Theo Jansen’s kinetic sculptures. I use videos of his wind-powered art to demonstrate use of alternative energy. It’s also a great way to infuse art appreciation into my engineering curriculum.

Here’s a video sample of his genius:

Flight Museum at LAX has an amazing collection of aviation uniforms.

Flight Museum at LAX has an amazing collection of aviation uniforms.